Tax Incentives to Help Build the Clean Energy Economy

Homeowners are eligible for up to $3,200* in tax credits every year for installing high efficiency equipment

*Up to $2,000 for eligible heat pumps and up to $600 for eligible ACs, furnaces and water heaters

Transitioning to a more efficient energy future

The majority of American homes still use fossil fuels, specifically natural gas, to power their appliances. Heat pump technology has improved to become 2 to 4 times more efficient than gas furnaces and serve a dual purpose as they also cool in the summer.

Heat pumps rely on electricity to run so as the grid transitions to rely more on renewable energy, their impact on the environment is significantly lower than fossil fuel reliant equipment.

To help homeowners with this transition, the Inflation Reduction Act provides a set of tax credits which are available now and rebates which will be available in early 2024.

What this means for your business

Starting in January 2023, homeowners with taxable income can get a 30% tax credit for up to $3,200 every year until 2032.

- Up to $2,000 tax credit every year for eligible heat pumps.

- Up to $1,200 tax credits for other energy efficiency improvements including ACs, furnaces and water heaters (up to $600 tax credit/year), energy audits, insulation, and electrical panels.

High Efficiency Homes and Rebates Act (HEEHRA)

The Inflation Reduction Act is also providing rebates mostly targeted to low and medium income (LMI) households which will be managed by state energy offices and will become available in individual states starting in early 2024.

Households can claim a maximum rebate of $14,000 for eligible improvements including:

- Up to $8,000 for eligible heat pumps

- Up to $1,750 for heat pump water heaters

- Up to $8,000 for all electric heat pumps

- Up to $1,750 for heat pump water heater

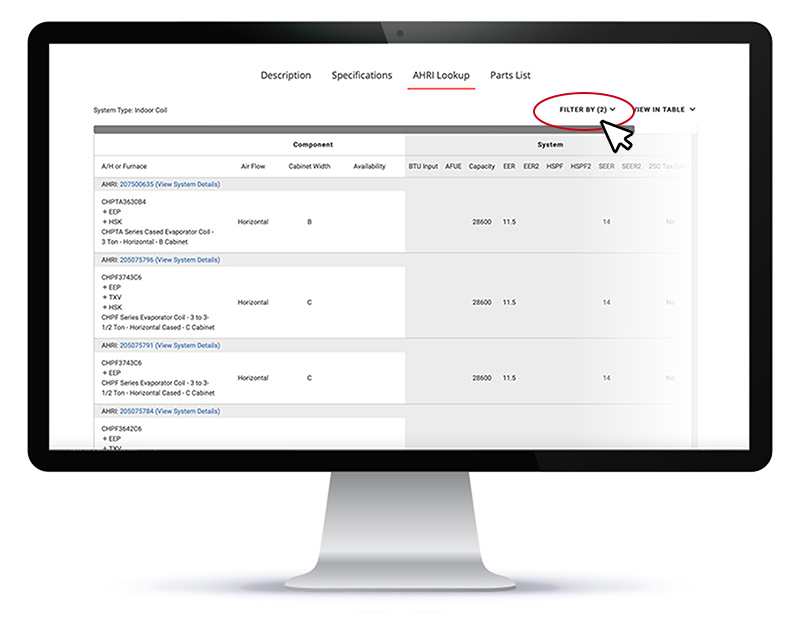

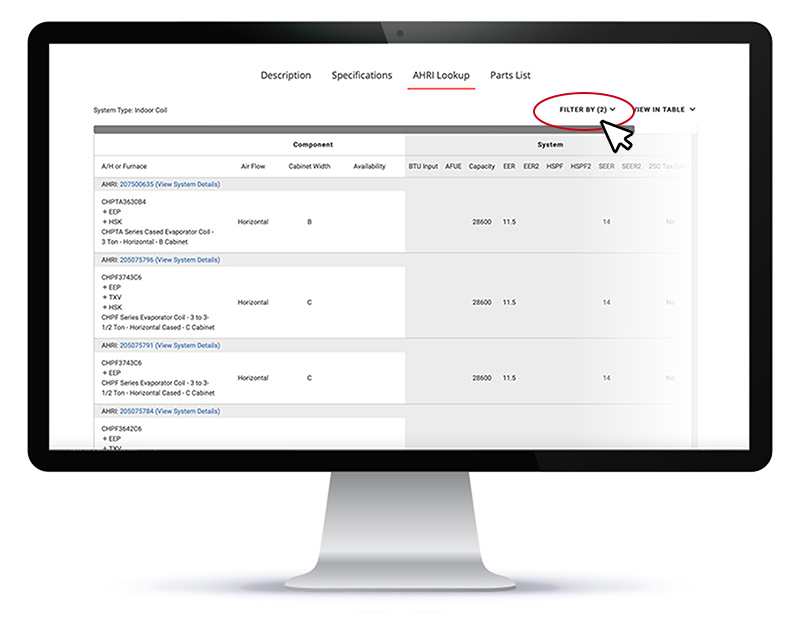

Use our AHRI Lookup Tool to Check for Tax Eligibility

When using our AHRI Lookup tool on our website, you can view potential eligibility for an IRA tax credit on specific matched systems.